Deciphering The Landscape: A Guide To Rockland County’s Tax Map

Deciphering the Landscape: A Guide to Rockland County’s Tax Map

Related Articles: Deciphering the Landscape: A Guide to Rockland County’s Tax Map

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Deciphering the Landscape: A Guide to Rockland County’s Tax Map. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Deciphering the Landscape: A Guide to Rockland County’s Tax Map

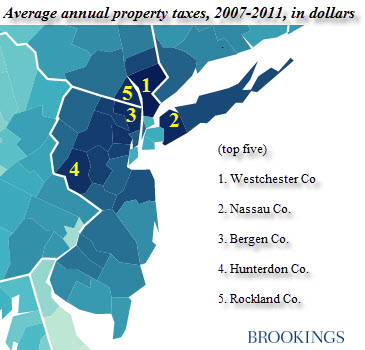

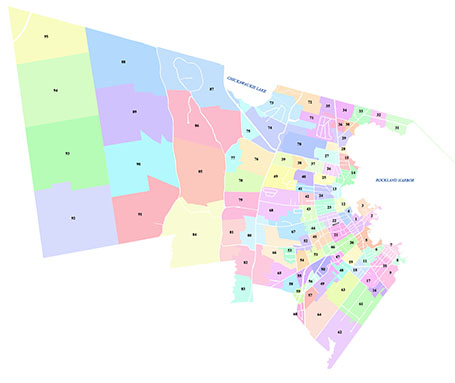

Rockland County, nestled in the heart of New York’s Hudson Valley, boasts a diverse landscape that encompasses rolling hills, vibrant towns, and picturesque waterways. This unique environment is mirrored in its intricate system of property ownership, meticulously documented on the county’s tax map. This comprehensive guide delves into the intricacies of this map, shedding light on its significance for residents, businesses, and those seeking to understand the county’s land distribution.

The Foundation of Property Identification:

The Rockland County tax map serves as a cornerstone for property identification and management. It is a meticulously crafted visual representation of the county’s land parcels, providing a detailed overview of property boundaries, ownership, and associated tax information. This map acts as a centralized repository, facilitating a range of critical functions, including:

- Property Assessment: The tax map forms the basis for assessing the value of each property, a crucial element in determining property taxes.

- Tax Collection: By clearly identifying property owners, the tax map enables efficient and accurate tax collection, ensuring the smooth functioning of county services.

- Land Transactions: During property sales or transfers, the tax map serves as a vital reference point for verifying property details and ensuring accurate documentation.

- Planning and Development: The map provides valuable insights into land ownership patterns, aiding in the development of comprehensive planning strategies for future growth and infrastructure projects.

- Emergency Response: In the event of emergencies, the tax map assists first responders in quickly locating properties and identifying potential hazards, facilitating swift and effective action.

Navigating the Map: A Step-by-Step Guide:

The Rockland County tax map is a complex document, requiring careful navigation to extract the desired information. It is typically divided into sections known as "tax lots," each representing a distinct property. Each tax lot is assigned a unique identification number, providing a clear and unambiguous reference point.

To access the tax map, individuals can utilize the following resources:

- Rockland County Website: The county’s official website offers an online portal for accessing the tax map, allowing users to search by address, property ID, or owner’s name.

- County Assessor’s Office: The Rockland County Assessor’s office provides access to the tax map in person, allowing individuals to consult the map directly and receive assistance from trained staff.

- Real Estate Professionals: Real estate agents and brokers typically have access to the tax map, providing valuable support for property transactions and inquiries.

Understanding the Map’s Key Elements:

The tax map is a visually rich document, employing a range of symbols and notations to convey information effectively. Here are some key elements to understand:

- Property Boundaries: The map clearly delineates the boundaries of each property, using lines and markers to represent fences, roads, and other physical features.

- Tax Lot Numbers: Each property is assigned a unique tax lot number, facilitating easy identification and reference.

- Property Ownership: The map includes information on the current owner of each property, typically displayed alongside the tax lot number.

- Property Features: The map may include additional details about each property, such as its size, zoning classification, and the presence of buildings or structures.

- Legend: A key or legend accompanies the map, providing explanations for the symbols and notations used to represent different features.

Beyond the Map: Additional Resources:

While the tax map provides a comprehensive overview of property information, additional resources can offer further insights and support:

- Assessment Records: The county assessor’s office maintains detailed assessment records for each property, including information on its value, improvements, and tax history.

- Zoning Regulations: The county’s zoning ordinances provide guidelines for land use and development, outlining permitted activities and restrictions for different areas.

- Environmental Data: The county may have access to environmental data, such as soil conditions, flood zones, and hazardous waste sites, which can be valuable for property planning and development.

FAQs about Rockland County’s Tax Map:

1. How can I access the tax map online?

The Rockland County website offers an online portal for accessing the tax map, allowing users to search by address, property ID, or owner’s name.

2. What information can I find on the tax map?

The tax map provides information on property boundaries, ownership, tax lot numbers, property features, and zoning classifications.

3. How often is the tax map updated?

The tax map is typically updated annually to reflect changes in property ownership, boundaries, and other relevant information.

4. Can I obtain a copy of the tax map for a specific area?

The Rockland County Assessor’s office can provide copies of the tax map for specific areas upon request.

5. Is there a fee for accessing the tax map?

Access to the tax map is typically free, though fees may apply for obtaining printed copies or specific reports.

Tips for Using the Rockland County Tax Map:

- Familiarize yourself with the map’s legend: Understanding the symbols and notations used on the map is crucial for effective interpretation.

- Use multiple search methods: Utilize address, property ID, or owner’s name to locate the desired property on the map.

- Consult with professionals: If you require assistance in navigating the map or interpreting its information, consider consulting with a real estate professional or the county assessor’s office.

- Stay informed about updates: The tax map is updated regularly, so it is essential to stay informed about the latest revisions.

Conclusion:

The Rockland County tax map serves as a vital tool for navigating the county’s intricate landscape of property ownership. It provides a comprehensive overview of property boundaries, ownership, and associated tax information, facilitating a range of critical functions, including property assessment, tax collection, land transactions, planning, and emergency response. By understanding the map’s structure, key elements, and available resources, individuals can effectively utilize this valuable tool to gain insights into property information, navigate land transactions, and contribute to the ongoing development and management of Rockland County’s diverse and dynamic landscape.

Closure

Thus, we hope this article has provided valuable insights into Deciphering the Landscape: A Guide to Rockland County’s Tax Map. We appreciate your attention to our article. See you in our next article!