Navigating Property Information: A Comprehensive Guide To The Canyon County Assessor Map

Navigating Property Information: A Comprehensive Guide to the Canyon County Assessor Map

Related Articles: Navigating Property Information: A Comprehensive Guide to the Canyon County Assessor Map

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating Property Information: A Comprehensive Guide to the Canyon County Assessor Map. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Property Information: A Comprehensive Guide to the Canyon County Assessor Map

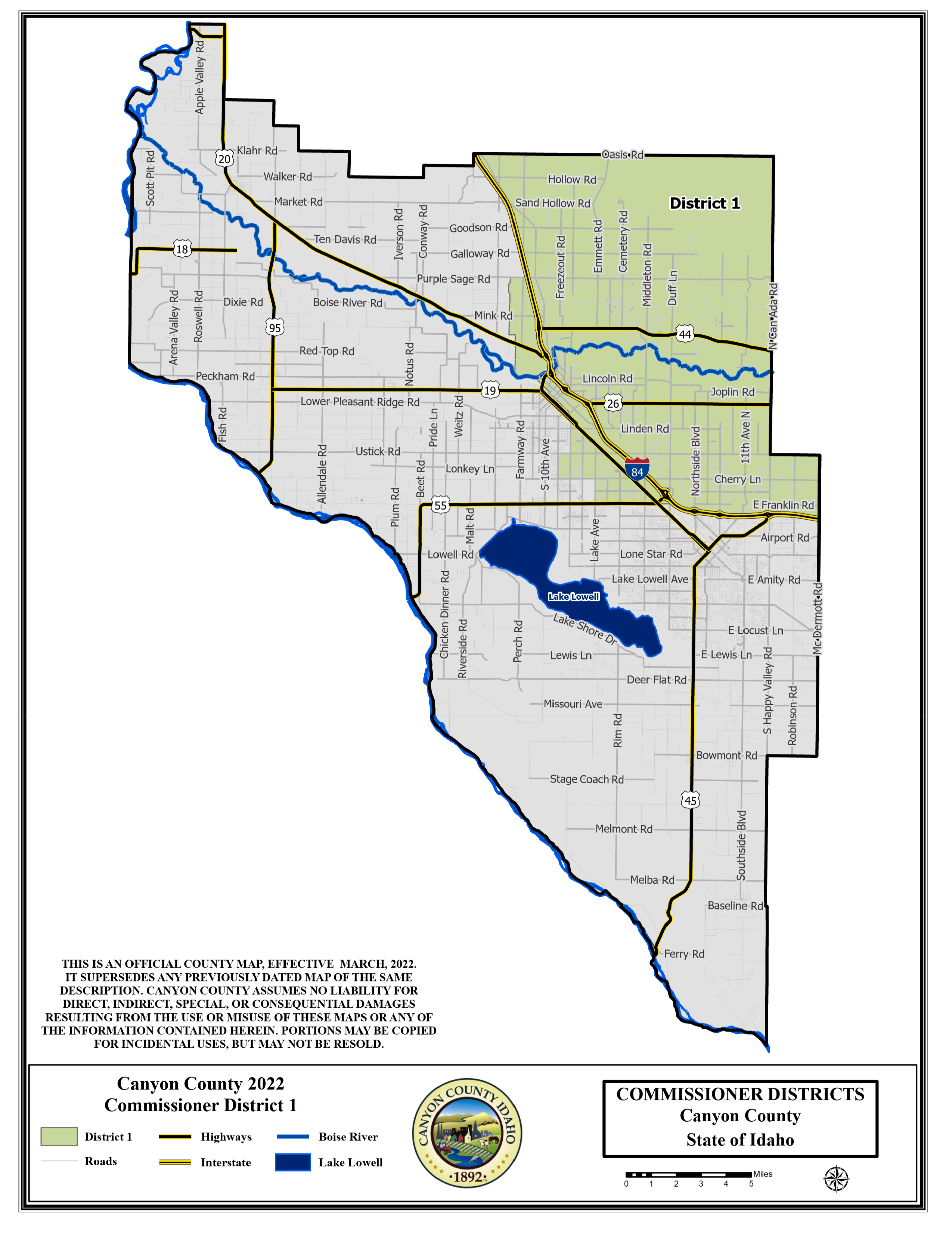

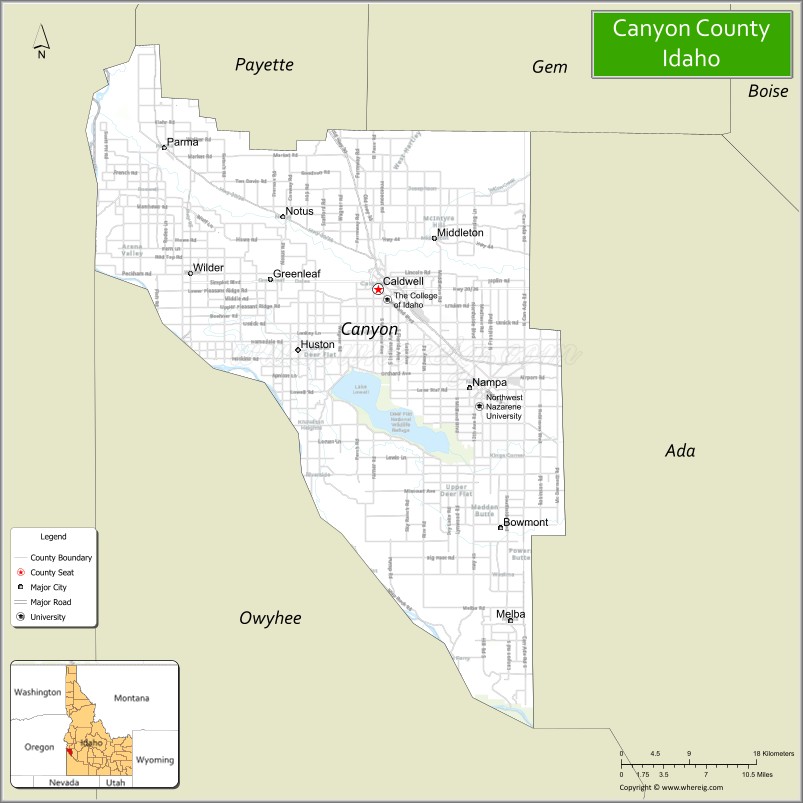

The Canyon County Assessor’s Office plays a vital role in Idaho’s property management system. Central to its operations is the Canyon County Assessor Map, an invaluable tool for understanding property boundaries, values, and related information. This comprehensive guide explores the map’s features, functionalities, and its significance in various aspects of real estate and property management.

Understanding the Foundation: The Role of the Canyon County Assessor

The Canyon County Assessor’s primary responsibility is to assess the value of all real and personal property within the county. This process ensures fair and equitable taxation for all residents. The Assessor’s Office maintains a detailed database of property information, including ownership details, property types, and assessed values. The Canyon County Assessor Map serves as a visual representation of this database, allowing users to navigate and access this crucial information with ease.

Navigating the Map: Exploring the Features and Functionalities

The Canyon County Assessor Map is a user-friendly online tool that provides a comprehensive overview of properties within Canyon County. Its key features include:

- Interactive Interface: The map is designed to be highly interactive, allowing users to zoom in and out, pan across the county, and select specific properties for detailed information.

- Property Boundaries: The map clearly delineates property boundaries, making it easy to identify individual parcels of land and their respective dimensions.

-

Property Information: Clicking on a specific property reveals a wealth of information, including:

- Property Address: The official address assigned to the property.

- Legal Description: A detailed legal description of the property, including its location and boundaries.

- Assessed Value: The current assessed value of the property, which is used to calculate property taxes.

- Owner Information: Contact details of the property owner, including name and address.

- Property Type: The type of property, such as residential, commercial, or agricultural.

- Tax Information: Details about the property’s tax status, including outstanding taxes and payment history.

- Search Functionality: The map incorporates a powerful search function, allowing users to find specific properties by address, legal description, or owner name.

-

Data Layers: The map offers various data layers that can be toggled on and off, providing users with a customizable view of the information they need. These layers might include:

- Aerial Imagery: Recent aerial photographs of the county, providing a visual context for property locations.

- Zoning Districts: Information about the zoning regulations applicable to different areas within the county.

- Road Networks: A detailed map of roads and highways within the county.

- Public Utilities: Locations of utilities such as water lines, sewer lines, and power lines.

- Historical Data: Some maps may provide access to historical property data, allowing users to track changes in property values and ownership over time.

Benefits of Utilizing the Canyon County Assessor Map

The Canyon County Assessor Map offers a multitude of benefits to individuals and organizations alike:

- Real Estate Professionals: Real estate agents, appraisers, and developers can use the map to research properties, assess market trends, and identify potential investment opportunities. The map’s detailed information about property boundaries, values, and ownership helps them make informed decisions.

- Homeowners: Homeowners can use the map to verify their property details, track their assessed value, and access information about their property taxes. They can also use the map to research properties in their neighborhood, gaining insights into market trends and potential property values.

- Businesses: Businesses can use the map to locate potential commercial properties, assess the surrounding area, and research zoning regulations. The map’s data on utilities and infrastructure can also be helpful for businesses planning expansions or new developments.

- Government Agencies: The map is a valuable resource for government agencies, such as planning departments and tax assessors. It provides them with accurate and up-to-date information about property ownership, boundaries, and values, supporting their decision-making processes.

- Public Access to Information: The Canyon County Assessor Map promotes transparency and accountability by providing the public with easy access to property information. This access empowers citizens to understand the property assessment process and engage in informed discussions about local tax policies.

Frequently Asked Questions (FAQs) About the Canyon County Assessor Map

1. How do I access the Canyon County Assessor Map?

The map is typically accessible through the Canyon County Assessor’s Office website. You can usually find a link to the map on the website’s homepage or within the "Property Information" or "Maps" section.

2. Is the map available on mobile devices?

Most Assessor’s Office maps are designed to be responsive, meaning they can be accessed and used on mobile devices such as smartphones and tablets. However, it’s always best to check the website for specific instructions and compatibility information.

3. What if I can’t find the information I need on the map?

If you encounter any difficulties or have specific questions about property information, it’s recommended to contact the Canyon County Assessor’s Office directly. They can provide further assistance and access to additional resources.

4. How often is the map updated?

The frequency of map updates varies depending on the Assessor’s Office policies. However, most maps are updated regularly to reflect changes in property ownership, values, and other relevant information.

5. Is the information on the map accurate?

The Canyon County Assessor’s Office strives to maintain accurate and up-to-date information on the map. However, errors or inconsistencies may occur. It’s always advisable to verify any critical information with the Assessor’s Office before making important decisions.

Tips for Utilizing the Canyon County Assessor Map

- Familiarize Yourself with the Interface: Take some time to explore the map’s features and functionalities before using it for specific tasks. This will help you navigate the map efficiently and find the information you need.

- Use the Search Function: The search function is a powerful tool for finding specific properties quickly. Enter relevant details like address, legal description, or owner name to narrow down your search.

- Utilize Data Layers: Toggle different data layers on and off to customize your view and focus on the information that is most relevant to your needs.

- Check for Updates: Be aware that the map may be updated regularly. It’s good practice to check for recent updates before relying on any specific information.

- Contact the Assessor’s Office for Assistance: If you have any questions or encounter any difficulties using the map, don’t hesitate to contact the Canyon County Assessor’s Office for assistance.

Conclusion

The Canyon County Assessor Map is an invaluable resource for individuals, businesses, and government agencies seeking access to property information within Canyon County. Its user-friendly interface, comprehensive data, and powerful search functionality make it a vital tool for real estate transactions, property research, and informed decision-making. By understanding the map’s features and functionalities, users can leverage its benefits to navigate property information effectively and make informed decisions about real estate and property management.

![]()

Closure

Thus, we hope this article has provided valuable insights into Navigating Property Information: A Comprehensive Guide to the Canyon County Assessor Map. We appreciate your attention to our article. See you in our next article!