Navigating The Landscape: A Comprehensive Guide To York County Tax Maps

Navigating the Landscape: A Comprehensive Guide to York County Tax Maps

Related Articles: Navigating the Landscape: A Comprehensive Guide to York County Tax Maps

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Landscape: A Comprehensive Guide to York County Tax Maps. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Navigating the Landscape: A Comprehensive Guide to York County Tax Maps

- 2 Introduction

- 3 Navigating the Landscape: A Comprehensive Guide to York County Tax Maps

- 3.1 The Foundation of Property Information

- 3.2 A Deeper Dive into the York County Tax Map

- 3.3 Understanding the Importance of Tax Assessments

- 3.4 Navigating the York County Tax Map: A Step-by-Step Guide

- 3.5 Frequently Asked Questions About the York County Tax Map

- 3.6 Tips for Using the York County Tax Map Effectively

- 3.7 Conclusion

- 4 Closure

Navigating the Landscape: A Comprehensive Guide to York County Tax Maps

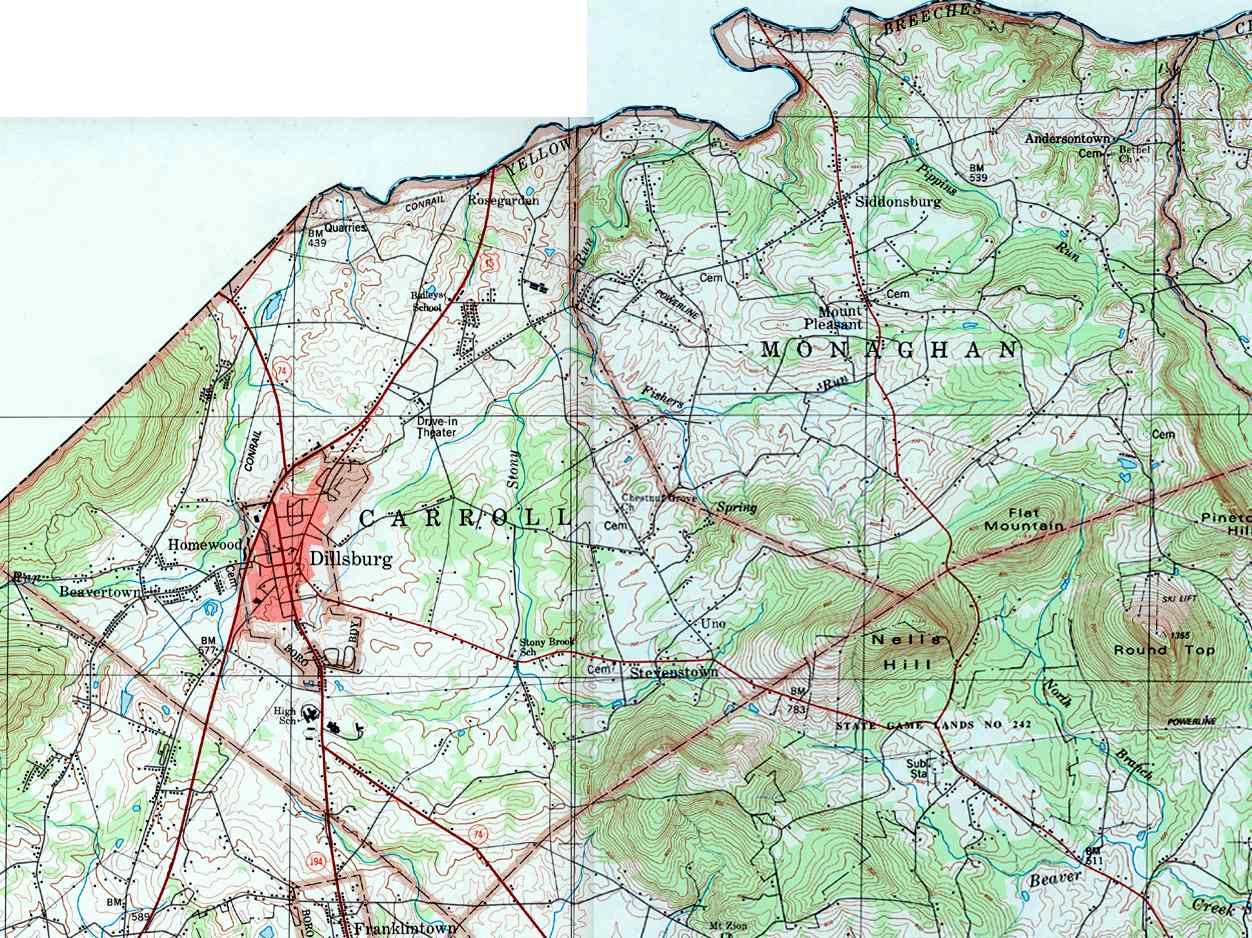

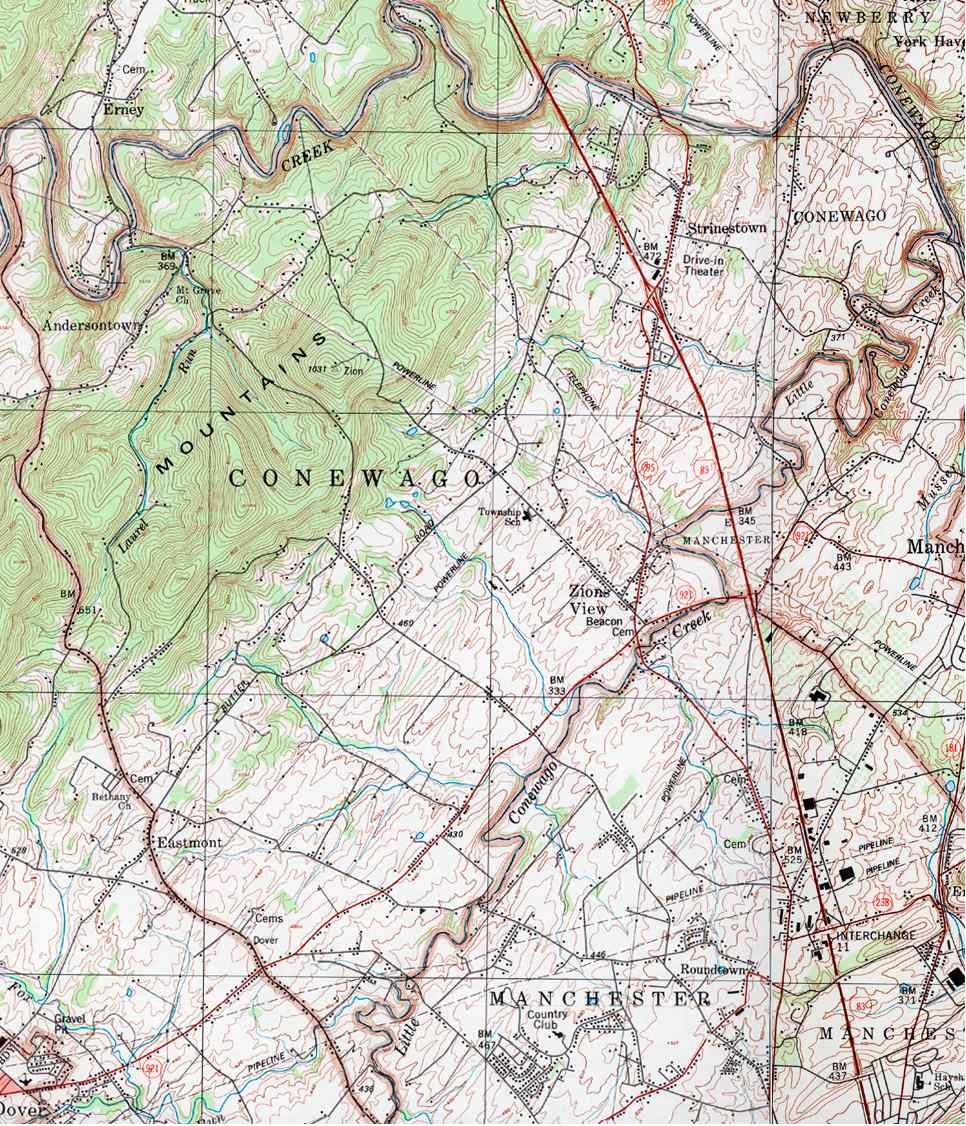

Understanding the intricate web of property ownership and taxation within any municipality is essential for informed decision-making, whether it be for personal or business purposes. In York County, Pennsylvania, the York County Tax Map serves as a crucial tool for navigating this complex landscape, providing a visual representation of property boundaries, ownership details, and tax assessment information.

The Foundation of Property Information

The York County Tax Map, maintained and updated by the York County Assessment Office, is a digital and physical resource that visually portrays the county’s property landscape. It divides the county into various sections, known as "tax parcels," each representing a distinct piece of land with its unique identification number, legal description, and ownership details. This comprehensive map serves as a vital resource for:

- Property Owners: Understanding the boundaries of their property, identifying potential encroachments, and accessing information about their tax assessments.

- Real Estate Professionals: Conducting property searches, verifying property information, and supporting property transactions.

- Government Agencies: Managing property tax collection, planning for infrastructure development, and addressing property disputes.

- The Public: Accessing information about property ownership, tax assessments, and the distribution of land within the county.

A Deeper Dive into the York County Tax Map

Beyond the visual representation, the York County Tax Map offers a wealth of information about each property parcel, including:

- Parcel Number: A unique identifier assigned to each property, facilitating easy identification and data retrieval.

- Legal Description: A detailed description of the property’s boundaries, using legal terminology and referencing nearby landmarks or natural features.

- Ownership Information: The names and addresses of the property owners, along with any recorded liens or encumbrances.

- Tax Assessment: The estimated market value of the property, used to calculate property taxes.

- Property Use: The classification of the property, such as residential, commercial, industrial, or agricultural.

- Property Features: Details about the property’s size, shape, and any existing structures, including improvements and utilities.

This detailed information is accessible through various channels:

- Online Portal: The York County Assessment Office provides an online portal where users can search for specific properties by parcel number, address, or owner name.

- Physical Maps: Hard copies of the York County Tax Map are available for purchase at the Assessment Office or through authorized vendors.

- GIS Data: The map data is also available in Geographic Information System (GIS) format, allowing for advanced analysis and visualization.

Understanding the Importance of Tax Assessments

The tax assessment, a crucial component of the York County Tax Map, plays a pivotal role in determining property taxes. This assessment represents the estimated market value of the property, based on factors such as:

- Location: The property’s proximity to amenities, transportation routes, and desirable neighborhoods.

- Size and Shape: The dimensions and configuration of the property, including any irregularities or unique features.

- Improvements: The presence of structures, such as houses, garages, or commercial buildings, and their condition.

- Market Conditions: The overall real estate market trends and the recent sale prices of comparable properties.

The York County Assessment Office conducts regular property revaluations to ensure that assessments accurately reflect current market values. Property owners have the right to appeal their assessment if they believe it is inaccurate or unfair.

Navigating the York County Tax Map: A Step-by-Step Guide

- Accessing the York County Assessment Office website: Begin by visiting the York County Assessment Office website, which provides a comprehensive portal for accessing property information.

- Choosing your search method: You can search for properties by parcel number, address, or owner name.

- Entering your search criteria: Input the relevant information into the search bar and click "Search."

- Viewing property details: The results will display a list of matching properties. Click on the desired property to view its details, including the parcel number, legal description, ownership information, tax assessment, and property features.

-

Exploring additional resources: The York County Assessment Office website also offers resources such as:

- Tax rate information: Details about the property tax rates for different property types.

- Property valuation guidelines: Explanation of the assessment process and factors considered in determining property value.

- Contact information: Contact details for the Assessment Office staff for any inquiries or assistance.

Frequently Asked Questions About the York County Tax Map

Q: How do I find my property on the York County Tax Map?

A: You can search for your property by parcel number, address, or owner name through the York County Assessment Office website.

Q: What information is included on the York County Tax Map?

A: The map provides information about property boundaries, ownership details, tax assessments, property use, and property features.

Q: How often are property assessments updated?

A: The York County Assessment Office conducts regular property revaluations to ensure that assessments accurately reflect current market values.

Q: Can I appeal my property assessment?

A: Yes, property owners have the right to appeal their assessment if they believe it is inaccurate or unfair.

Q: What are the different property classifications on the York County Tax Map?

A: The map classifies properties into different categories, such as residential, commercial, industrial, and agricultural.

Q: How do I contact the York County Assessment Office?

A: The Assessment Office website provides contact information, including phone numbers, email addresses, and office hours.

Tips for Using the York County Tax Map Effectively

- Familiarize yourself with the map’s layout and features: Take time to understand the different sections and symbols used on the map.

- Use the online portal to search for specific properties: The online portal offers a user-friendly interface and advanced search options.

- Verify property information with official records: Always double-check the information on the map with official property records.

- Contact the Assessment Office if you have any questions: The Assessment Office staff is available to provide assistance and answer any queries.

- Keep up-to-date on changes to the map: The Assessment Office regularly updates the map, so check for any revisions or new information.

Conclusion

The York County Tax Map serves as an indispensable tool for navigating the county’s property landscape, providing a comprehensive and accessible resource for property owners, real estate professionals, government agencies, and the public. By understanding the information provided on the map, users can make informed decisions about property ownership, taxes, and other related matters. Whether you are a homeowner, a business owner, or a curious individual, the York County Tax Map offers a valuable window into the county’s property landscape, empowering you with knowledge and clarity.

.png)

Closure

Thus, we hope this article has provided valuable insights into Navigating the Landscape: A Comprehensive Guide to York County Tax Maps. We thank you for taking the time to read this article. See you in our next article!